Tax Compliance for Accounts Payable

- KPMG-approved tax capability for IRS

- Collect and validate IRS and VAT tax IDs

- Maintain W-9, W-8BEN, VAT Details

- Walk suppliers through complex requirements

- Provide 1099, 1042-S, and DAC7 preparation reports

- Simplify your annual 1099 filing with e-Filing integration

Be IRS-Compliant & Slash Tax Risks

Tipalti’s tax solution for US payers simplifies the process and helps your company comply with IRS tax provisions. You can require all payees to fill out tax forms or provide their VAT/local tax ID as part of self-registration on the Tipalti portal. You can rest easy knowing your AP operation is always up-to-date with the latest US tax laws.

- Meets IRS requirements, as prescribed by KPMG.

- Optionally set tax ID submission as a requirement during onboarding, regardless if they hit the IRS $600 threshold.

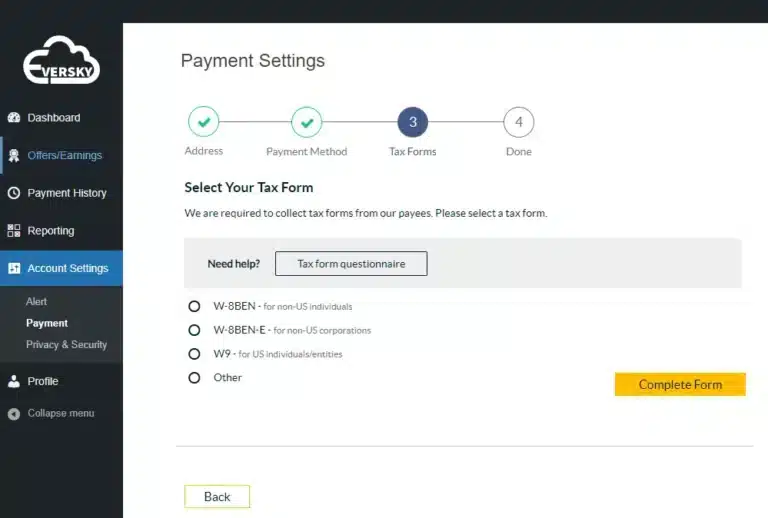

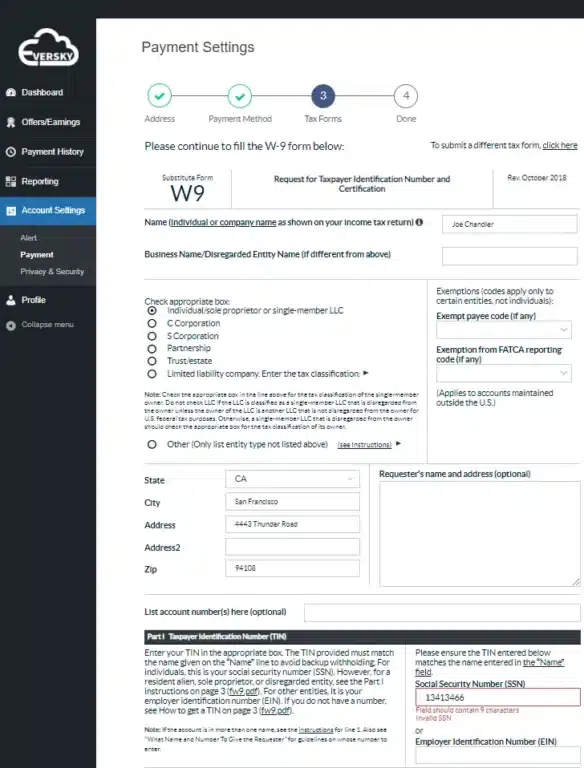

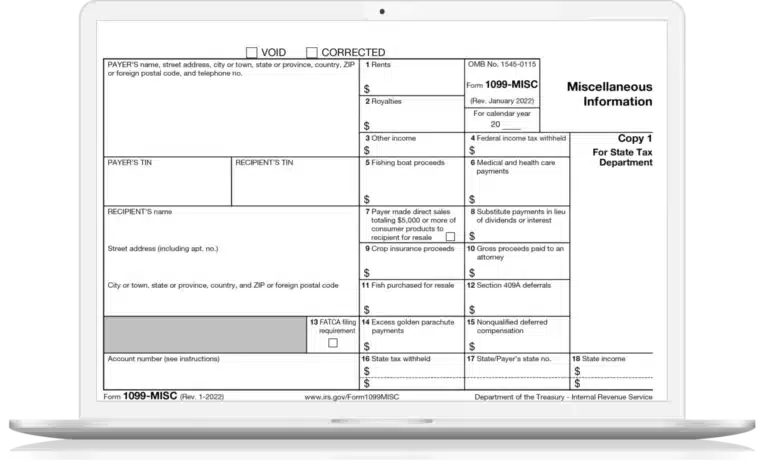

Digitize Tax Form Collection & Validation for Ease of Use

Tipalti’s guided tax form wizard helps suppliers of US payers choose the correct form based on country and business structure. Once the correct tax form is selected, Tipalti digitizes the tax form documents and applies 1,000+ rules including TIN matching to ensure the proper data has been provided. At year-end, Tipalti generates 1099 / 1042-S tax preparation reports and calculates any necessary withholdings.

- Supports W-9, W-8BEN, W-8BEN-E, W-8EXP, W-8IMY, W-8ECI, W-4 or Form 8233

- Tax IDs are collected digitally and optimized for electronic signatures.

- Verification ensures tax information is complete and helps protect from IRS penalties.

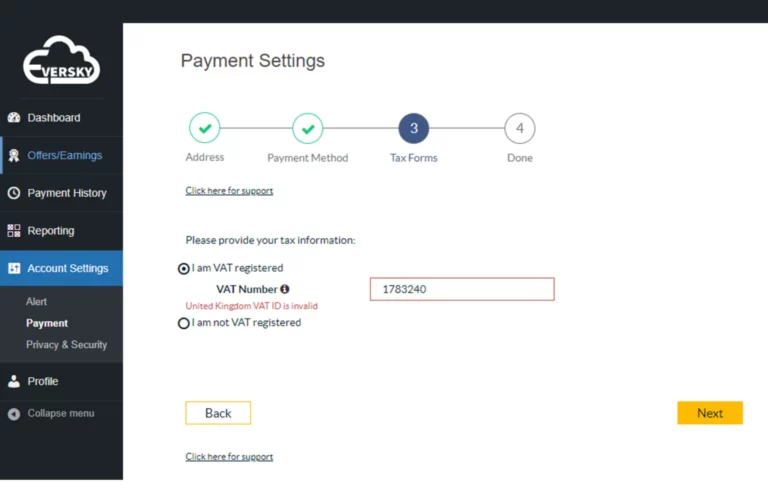

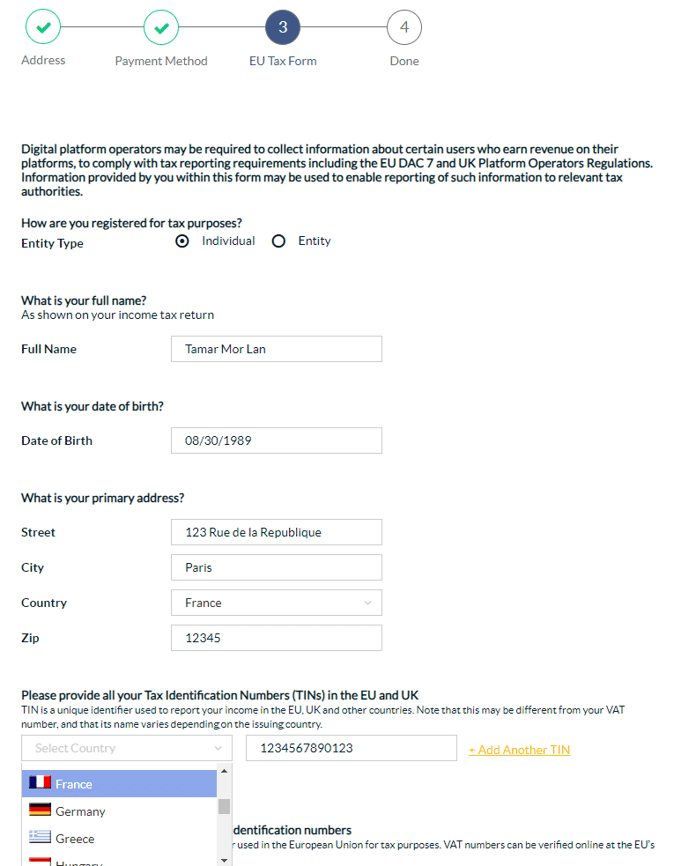

Confidently Go Global with International Tax Capabilities

For non-US payers, local and VAT tax ID collection is available. For European countries, Tipalti also supports document collection so suppliers can provide additional information when needed and self-billing invoices where suppliers must approve invoices before payments can be processed.

- Collecting and validating local & VAT tax IDs in 49 countries.*

- Built-in tax engine validates against 3,000+ rules to help prevent ID errors and issues.

*Supported countries are: Argentina, Australia, Austria, Azerbaijan, Belgium, Brazil, Bulgaria, Canada, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Denmark, Dominican Republic, Estonia, Finland, France, Germany, Greece, Honduras, Hong Kong, Hungary, India, Ireland, Italy, Japan, Latvia, Lithuania, Luxembourg, Malta, Mexico, Netherlands, Paraguay, Peru, Poland, Portugal, Romania, Russian Federation, Saudi Arabia, Singapore, Slovakia, Slovenia, Spain, South Korea, Sweden, Ukraine, United Kingdom, and Uruguay.

Simplify your annual 1099 filing with Tipalti’s e-Filing integration

Save time and improve efficiency with Tipalti’s e-Filing integration. Give your team the tools they need to avoid the end-of-year crunch and get your 1099 tax filings completed and out the door before the IRS’s deadline of January 31.

With Tipalti’s integration to Zenwork’s Tax1099.com solution, you can eFile 1099-MISC and 1099-NEC documents with the IRS and send the forms electronically and/or via USPS to recipients.

Streamlined compliance with DAC7 tax rules for digital plaforms

Tipalti collects the necessary payee data, executes your global payments, and produces tax preparation reports to save you time complying with the EU’s DAC7 reporting obligations for digital platforms.

DAC7 features can be enabled alongside Tipalti’s IRS and international tax capabilities for seamless multijurisdictional tax compliance in a single solution. The solution is also suitable for compliance with the UK Platform Operators Regulations.

Yariv Davidovich | PRESIDENT AT INFOLINKS

By implementing Tipalti’s solution, we were able to completely automate the collection of W-8/W-9 forms from 100% of our publishers, with no time invested by us. We also achieved complete tax compliance with regulations.

Innovation and efficiency

come built-in

Tipalti offers the most comprehensive payables technology to help your

business streamline, simplify, and evolve.

Invoice Management

Ditch the busy work with touchless invoice processing with smart OCR. Advanced approvals with AI streamlines the approval process and minimizes delays.

PO Management

Manage spend all in one place. Streamline purchase requests, PO’s, approvals, and vendors with budget visibility to make informed decisions.

Global Payments

Send payments in 120 currencies in 196 countries through six unique payment methods.

Currency Management

Save time and money on FX conversion payouts with highly competitive exchange rates.

Payment Reconciliation

Speed up financial close by 25%+ by synching and reconciling multi-entity payables data with ERP and Accounting systems.

Self-Billing Module

Simplify self-billing processes with automated invoice creation and submission while ensuring global regulatory compliance.

ERP Integration

Best-in-class integration with your existing ERP and accounting systems and sync invoices, suppliers, payments and purchase orders.

Payments API

Integrate any system through our highly secure API that offers full-featured interfaces.

Money Transmitter License

Get peace of mind for global transactions, more transparent controls and compliance review process by leveraging Tipalti’s banking and compliance rails.

Artificial Intelligence/Tipalti AI

Take advantage of proactive, smarter processes for the entire payables operation as well as greater efficiency and risk mitigation.

Supplier Management

Effortlessly onboard vendors with a multilingual, self-service portal that’s brandable. Plus, give suppliers a real-time view of payment and invoice status.

PO Matching

Eliminate overspending and strengthen financial controls with automated 2-way and 3-way matching and enjoy a frictionless approval cycle.

Tipalti Card

Gain complete control and visibility over your corporate credit and debit card spend with a solution integrated into the most powerful global payables solution with automatic reconciliation.

Multi-Entity

Manage unique payables workflows and centralize AP for subsidiaries and entities within a single instance.

Tax Compliance

Take the headaches out of collecting and validating IRS and VAT IDs. KPMG-approved for W-8/W-9 IRS requirements and generate 1099/1042-S tax prep reports.

Financial Controls

Enterprise-grade financial controls: Fraud, tax, regulatory, audit, spend and cash flow.

Fraud Detection

Tipalti Detect lets you proactively identify payee fraud risk and maintain a full audit trail.

Secure Cloud

Rest assured that data is collected, stored, and transmitted securely in the cloud. Tipalti is SSAE 18 and ISAE 3402 SOC 1 Type II and, SOC 2 Type I certified, and GDPR Compliant.

Simplify Performance-to-Pay

Easily sync data from marketplace platforms and tie performance analytics to pay partners.

Let’s get more productive

Talk to an expert and learn how you can take control of your payables.